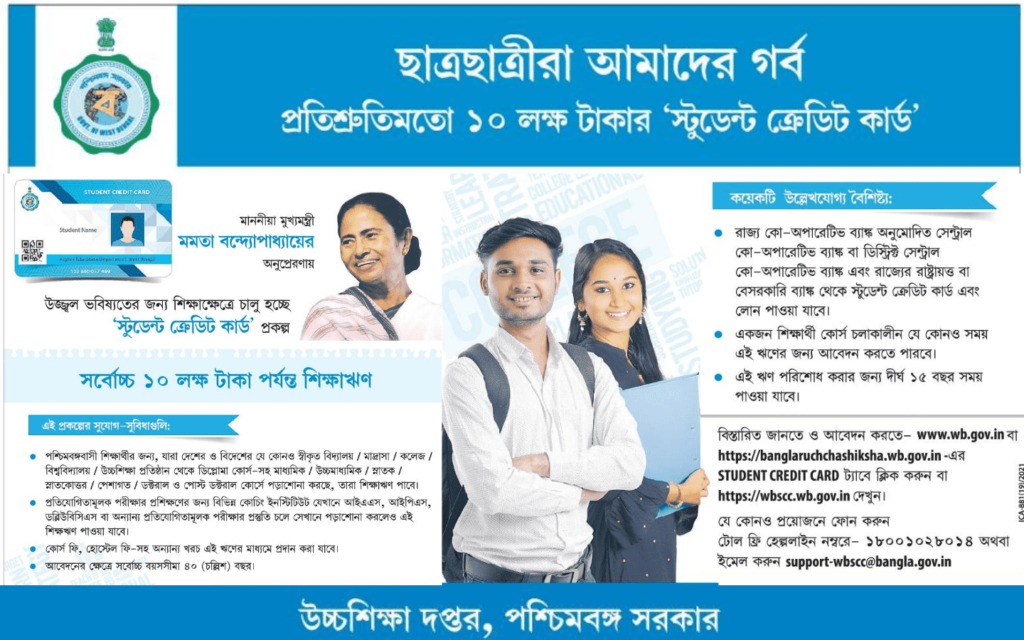

Apply Online for West Bengal Student Credit Card Scheme. Know the eligibility criteria and application process for WB Student Credit Card Education Loan with a low-interest rate. Get up to 10 lakhs through West Bengal Student Credit Card as education loan. List of required documents and eligible courses for this WB Student Credit Card Scheme.

The Government of West Bengal recently launched the Student Credit Card Scheme for School / College / University / Professional Institute / Coaching Institute students. Under this scheme, students will get a very low-interest education loan up to 10 lakhs from the bank for their higher studies.

Know all the detailed information about West Bengal Student Credit Card and its online application process. Know who can apply for this scheme and it’s maximum limit. List of required documents for WB Student Credit Card Application. Benefits of Student Credit Card and interest rates.

Eligible students can apply for WB Student Credit Card / Education Loan from wbscc.wb.gov.in website during any time of the course.

Contents

West Bengal Student Credit Card Scheme

Here are some basic information about this scheme for students.

| Scheme Name | West Bengal Student Credit Card |

| Scheme Type | Study Loan |

| Maximum Amount | Rs. 10 lakhs |

| Interest Rate | 4% |

| Eligible Courses | HS, UG, PG, Diploma, Training, Coaching etc |

| Application Mode | Online |

| Website | wbscc.wb.gov.in |

Objectives of WB Student Credit Card

Here are some main objectives of this student credit card scheme in West Bengal.

- The main aim of this scheme is to help the students financially for higher studies.

- Provide an education loan with a very low interest rate of only 4%.

- Get financial support / education loan without any mortgage at the bank.

- Help students to pay their institution fees like Engineering, Medical, LAW, IAS, WBCS etc coaching.

- Financial support for purchasing books / laptop / tablet / equipment etc.

- Students can apply for WBSCC anytime during the tenure of the course.

West Bengal Student Credit Card Scheme Eligibility

The students who might be thinking of applying for the West Bengal Student Credit Card (WBSCC) scheme online, must check the eligibility criteria of this scheme before apply.

These eligibility guidelines are mentioned / published on the official website of WB Student Credit Card Scheme, wbscc.wb.gov.in.

- The student or his family is residing in the State of West Bengal at least for a period of 10 years.

- The minimum eligibility to apply for the loan under the scheme is class IX past form any recognised Boards.

- Student pursuing High School, Undergraduate, Postgraduate courses including professional degree, Diploma courses and research at doctoral/postdoctoral level or other similar courses.

- Students of School, Madrasha, College, University and other institutions like IIT, IIM, IISc, IIEST, Business School can also apply for this student credit card.

- Students who are studying in various coaching institutes appear for appearing different competitive examinations like Engineering / Medical / Law, IAS, IPS, WBCS, SSC etc.

- Students studying outside India are also eligible to apply for Student Credit Card Scheme.

- The maximum age limit is 40 years at the time of applying for the loan.

Students pursuing their courses in distance learning mode are not eligible to apply for the West Bengal Student Credit Card Scheme.

Read More, Apply Online for Swami Vivekananda Merit cum Means Scholarship Scheme

WB Student Credit Card Information

Here are some important information about the West Bengal Student Credit Card Scheme. Know the loan amount, interest rate, bank details and repayment process of this study loan.

- The maximum amount of loan eligible under the scheme is Rs. 10 lakhs.

- There shall be a 4% simple rate of interest per annum of the loan amount.

- The repayment period shall be 15 years for this WB Student Credit Card Scheme Study Loan.

- There will be no processing charges / penalty for prepayment.

- The loan shall be repaid in EMI modes.

- There will be a life cover/life insurance in the name of the student upto the loan amount sanctioned. The insurance premium will be debited from the loan amount.

- There is no need for obtaining any NOC from the institution.

- Students can apply for loan under Student Credit Card Scheme anytime during the course.

- There are no marks percentage criteria for applying WB Student Credit Card.

Required Documents to Apply for WB Student Credit Card

The complete application process of West Bengal Student Credit Card is online. Candidates have to upload the scanned copies of the following documents at the time of online application.

- Coloured Photograph of the Applicant

- Coloured Photograph of the co-borrower / legal guardian

- Signature of the Student

- Signature of the co-borrower / guardian

- Aadhaar Card

- Class 10 Board Registration Certificate

- Co-borrower’s / Guardian’s address proof (Voter ID/Aadhaar)

- Current Course Admission Receipt

- Course fee/tuition fee receipt

- Student’s PAN Card or Declaration on prescribed format

- Co-borrower’s / Guardian’s PAN or Declaration on prescribed format.

All the documents should be uploaded in pdf format and the maximum size of the file is 400kb and minimum 100kb.

Read More, Kanyashree K3 Scholarship Online Application

WB Student Credit Card Online Application

Eligible students can apply online for the WB Student Credit Card Scheme. Students have to provide their basic details, academic details, contact details, and upload scanned copies of required documents at the time of online application.

The step by step online application process for West Bengal Student Credit Card study loan is described below. So before applying, must read this process for more clarity.

Step 1: Visit the official website of the West Bengal Student Credit Card Scheme (wbscc.wb.gov.in) and then click on the ‘Student Registration‘ option. Now fill the Student Registration form by providing basic details, the present course of study, contact details.

Step 2: After completion of the Registration process a unique ID will be generated which will be sent to your mobile number. This unique ID will be used as a User ID for all future references.

Step 3: Now login to the WBSCC portal using your User ID and Password. On the Student Credit card Dashboard, you can check the require activities.

Step 4: Click on the ‘Apply Now‘ option on the dashboard and fill the Application Form. Provide your Personal Details, Co-borrower details, Address, Course & Income Details, Bank details of the student and Co-borrower.

Step 5: Now upload the scanned copies of required documents on the application form. Then Submit the Application form for verification.

This is the complete online application process for West Bengal Student Credit Card. Sometimes, your HOI (Head of the Institution) may ask for hard copies of your WBSCC Application Form & other documents. So, contact once with your HOI regarding this.

Read More, List of Scholarships for West Bengal School/College/University Students

West Bengal Student Card Application Status

Learn how to check the online application status of West Bengal Student Credit Card (WBSCC). Students can check their application status online using Application ID and Password. Know when you will get your Student Credit Card from the bank and how long it will take.

- Visit the official website of West Bengal Student Credit Card (wbscc.wb.gov.in).

- Login with your Application ID and Password.

- On the dashboard, you can check your Application Status.

Types of Application Status Message

Here are some types of messages and it’s meanings shown on the Student Credit Card Application dashboard.

- Application Submitted to HOI: This message will be shown after submitting the online application form. This status means, your application forwarded to your Institution Head for verification.

- Application returned by HOI to APPLICANT: If your current HOI will find something wrong/error on your application form, then he will return/reject your application. In that case, you have the option to edit your application form and submit.

- Application forwarded by HOI to HED: HOI approved the application form and then forward it to the Higher Education Department for further verification.

- Application forwarded by HED to BANK: HED approved the application form and then forward it to the Bank for issuing Student Credit Card.

Helpline Phone Numbers

Students can directly contact the support team of the WBSCC Scheme. If you have any queries or help regarding West Bengal Student Credit Card call 1800-102-8014 or email at support-wbscc@bangla.gov.in mentioning your problem. Visit the official website of WB Student Credit Card, wbscc.wb.gov.in for more details. Students can also contact to their school, college, university, institution about this scheme.

West Bengal Student Credit Card FAQs

Here are some frequently asked question about this student credit card scheme / study loan scheme.

Who can apply for West Bengal Student Credit Card?

Students, who are residing in West Bengal at least for 10 years can apply for this credit card.

What is the maximum age limit for WB Student Credit Card?

The maximum age limit is 40 years.

Can Open University students apply for this scheme?

No. Students, who are pursuing their course in distance learning mode, cannot apply for WB Students credit Card.

What is the maximum time to repay the study loan?

The maximum time limit of WB Student credit card loan repayment is 15 years.

What is the minimum percentage require to apply for WB Student Credit Card?

There is no minimum percentage/marks required to apply for this scheme.

Can apply for this scheme, if I received scholarships from the government?

Yes, you can also apply for WB students credit card.

1800-102-8014 this number is invalid. It’s shows

Application pulled and forwarded to the bank,

Time limit expire, application auto pulled by the system

What does this mean? Do i need to worry?

What does application pulled and forwarded to bank mean ?

Who do i contact? what do i do now?

Do i have to contact the institutions to approve the application or wbscc helpline?

What happened next? Same happened with me

Hi.. I’m doing MA course in distance mode from rabindra Bharati University.. Can i apply for student credit card?

Hello Rituparna, yes you can apply for the student credit card.

Application pulled and forwarded to the bank,

Time limit expire, application auto pulled by the system

What does this mean?

sir i have applied for student credit card for my son now the application has been forwarded to bank i personally visited there they told me to apply on vidya laxmi portel.. pl guide me what should i do now

Hello Sir, please contact once to the Student Credit Card helpline number regarding this.

I’ve uploaded a wrong document and have done the final submission. My application has been forwarded to HOI. Is there any way I can edit the document?

Hello Tirna, request to you HOI to unlock your application. After that you can edit it.

How many days do the bank take to sanction the loan amount?

Will the bank contact us or we need to visit the bank once it shows application forwarded to bank .

Application Pulled and Forwarded to Bank remark : Time Limit Expire,Application Auto Pulled By System

means ?? what to do now

Hello Kunal, your WB Student credit card application may be inactivated due to no action taken by the bank or any intermediary. So, contact your college/university or the Students Credit Card helpline number for further information 1800-102-8014

.

Application

Returned by DNO , what does it means ?

Your SVMCM Scholarship application was returned by ‘District Nodal Officer’.

Hi,

I got the loan approved for one university , but now now since i got admit from another university do i need to cancel this card and apply fresh load for the new university ?

What can I do after showing ” Application forwarded by HED to bank ” ?

Hello Sneha, you don’t have to do anything. The bank authority will contact with you regarding your Student Credit Card.

Hello admin,

My application status show (Application forwarded to Bank by DNO) what does it means and how much it will take to get Loan sanctioned.

Hello Deepak, you don’t have to do anything. The bank authority will contact with you regarding your Student Credit Card.

If i take the loan of 8 lakhs and use only 5 lakhs. Will the interest be charged on 5 lakhs or 8 lakhs?

Hello Dhiraj, if you need only Rs. 5 lakh loan, then why apply for Rs. 8 lakh amount?

I didn’t mean that…. actually just in case if i take that amount and use the section of it. Then, the interest will be charged on complete amount or that section of the loan?

The interest will be charged on the full amount (Rs 8 lakh in your case).

Means i have to pay 8 lakhs even though i used only 5 lakhs.

Yes.

It’s wrong only taken/used amount’s interest will be charged. Like krishan Cradit Card.

While tracking application its shows that my application has been forwarded to HED.

How many days will it take to sanction the loan?

Once applied for Student Credit Card how long does it take for approval from all sides..? Once approved who will approach me for getting the loan..?

Hello Bipul, the complete process will take 15-30 working days for WB Students Credit Card. After getting approval from the all authorities, bank will credit the loan amount to your account.

Sir, I am a student of UG course. My financial situation is not well. So I want to take the loan. but having little chance to get a job after completing the course , will it be right to take the loan ?

Hello Soumishree, read the eligibility criteria of WB students credit card. If your course is eligible, then you can definitely apply for students credit card.

if i take the loan for engineering ,can i return the money in year after i got the job

suppose i got job after 4 years and return the money in 2 years after that ?

Hello Shazan, yes you can repay the students credit card loan after getting the job.

Who is exactly meant by HOI? And I am a student of Lovely Profession University so who is exactly expected to review my documents?

Hello Arnab, the full form of HOI is ‘Head of the Institution’. So your college/university principal is the HOI.

Can i take this loan for nursing admission?

Hello Ambika, after taking admission to the nursing course, you can apply for WB Student credit card.